Thoughts on Power

forward reliability co-auctions for fun and profit

The U.S. electric grid is facing a dual challenge that’s becoming impossible to ignore: it must rapidly integrate new power sources to meet staggering new demand while ensuring the system remains rock-solid during extreme weather events and peak use. Blackouts and price spikes during scorching summers or frigid winters remind us that reliability isn’t optional.

Right now, different parts of the country swing to extremes on this spectrum. Some regions prioritize speed, letting projects connect quickly and dealing with any resulting grid congestion through real-time adjustments. Others emphasize caution, holding up connections until exhaustive studies and infrastructure upgrades are complete. The outcome? Either hasty integrations that risk instability, or plodding approval processes that stifle growth and innovation.

What if we didn’t have to pick one over the other? A smarter path forward could blend these approaches in a hybrid model: allow new resources to connect swiftly after passing essential safety checks, but overlay a straightforward incentive mechanism to secure reliability for those critical “crunch” moments.

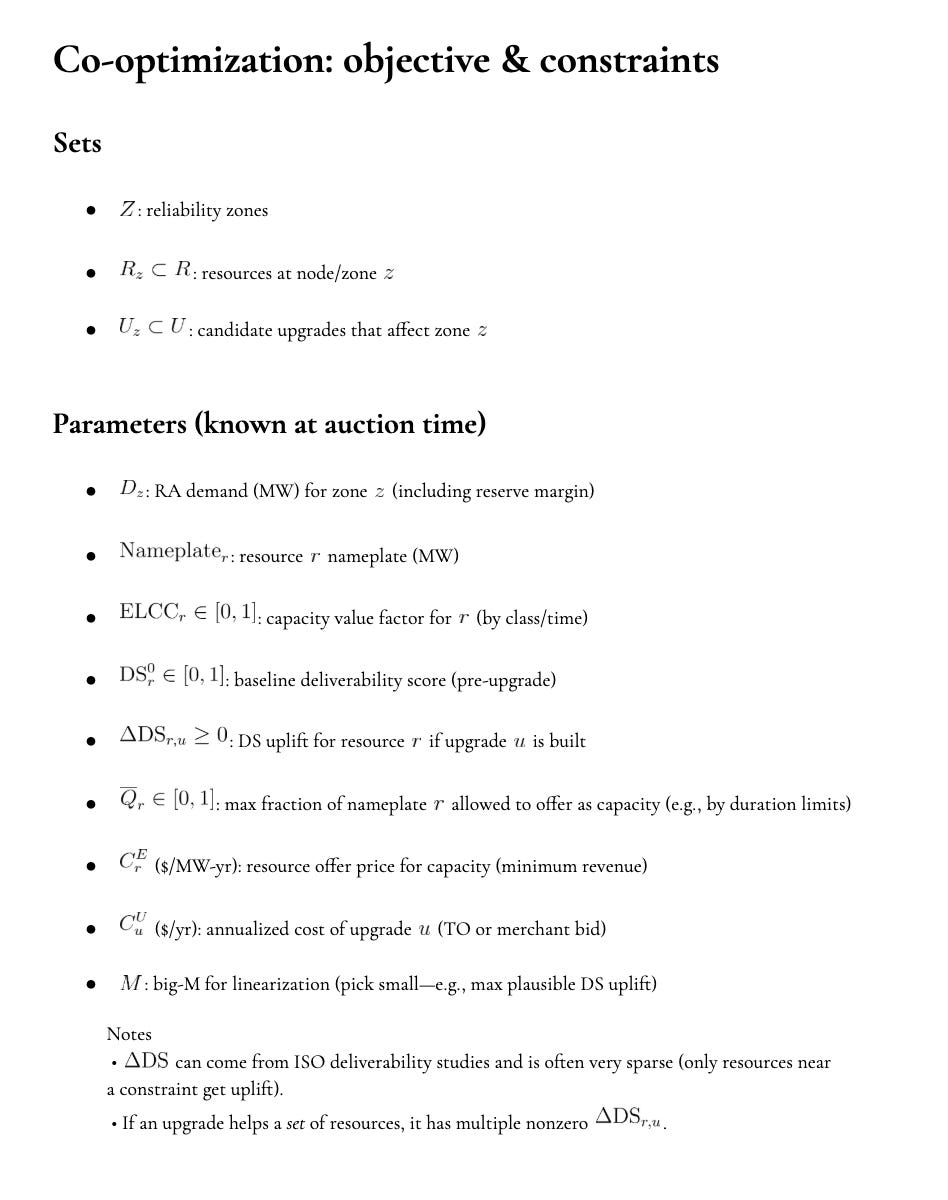

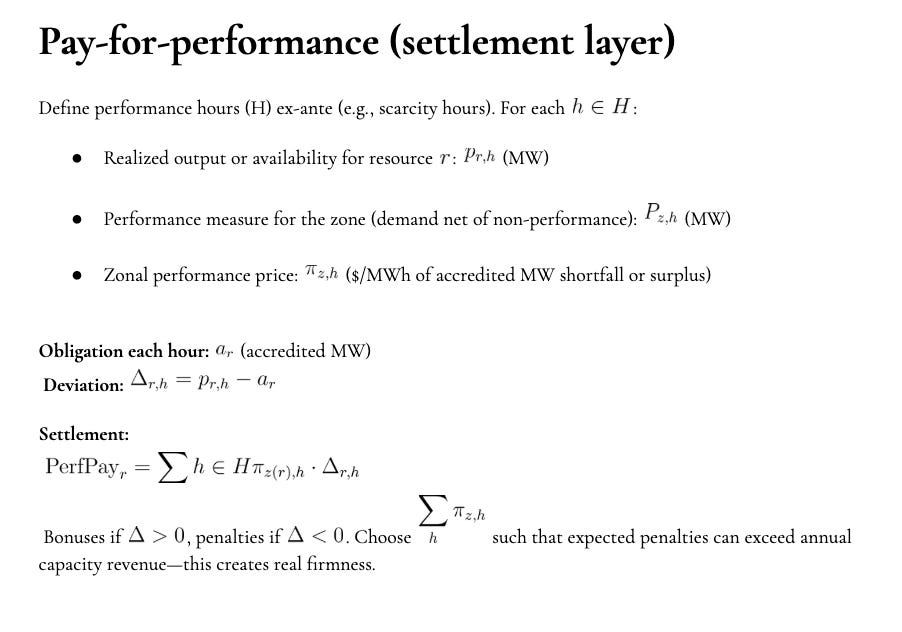

At the heart of this idea is a way to value each new power project not just for the energy it produces day-to-day, but for its proven ability to contribute when the system is under stress. Every plant, battery, or renewable installation could energize and start selling electricity almost immediately under a “connect-and-manage” framework (this is how Texas does it), where congestion is handled on the fly through market signals. However, to earn a spot in the grid’s reliability reserves—the backup capacity we rely on during peak emergencies—each resource would receive an “accredited” score. This score reflects two key factors: how well the resource performs during high-stress periods (think a battery discharging at dusk when solar fades, versus a solar array that’s offline after sunset) and how effectively its power can actually reach demand centers without getting bottlenecked by transmission lines. Multiply these elements, and you get a measure of its true reliability contribution.

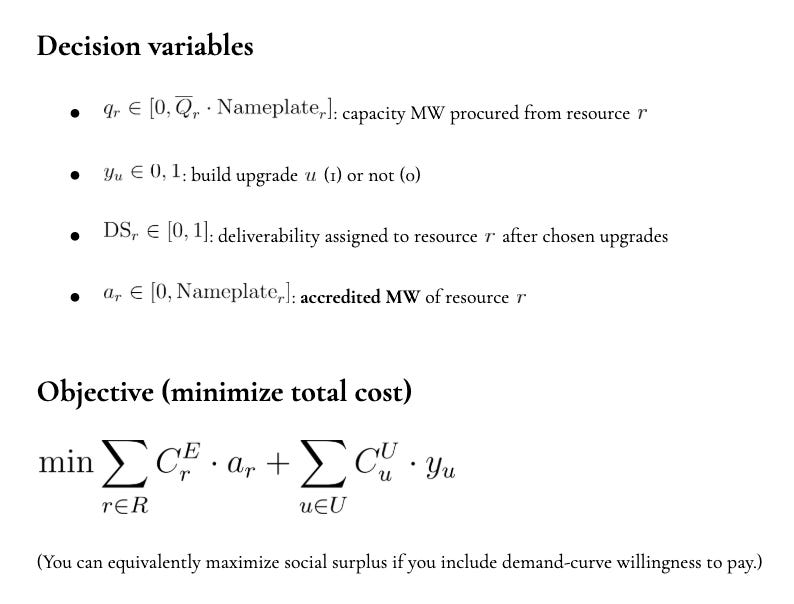

To make this actionable, grid operators could host an annual auction a few years in advance to procure the reliability they need. Projects would bid their accredited capacity at a certain price, but here’s the novel twist: the auction wouldn’t just shop for more power plants or batteries, it would also consider a curated list of targeted, ready-to-build grid enhancements—like upgrading a specific substation or adding a transmission line—that could unlock additional deliverable capacity in congested areas.

The system would then select the most cost-effective mix: maybe it’s cheaper to build a modest upgrade that boosts reliability for multiple existing resources than to overbuild new generation elsewhere. This co-optimization ensures we’re not gambling on the grid during heat waves or cold snaps, while avoiding the trap of delaying connections for massive, multi-year infrastructure overhauls.

Incentives are baked in to keep everyone aligned. If a resource commits to reliability payments but fails to deliver during actual emergencies, it faces hefty penalties—encouraging owners to invest in maintenance and performance. Conversely, overachievers could earn bonuses, rewarding innovation like longer-duration batteries or weather-resilient designs. For grid operators and utilities, this setup shifts focus from blanket spending on “the grid” to transparent, competitive choices: is it more economical to secure extra firm capacity for the next few seasons, or to fund a pinpointed upgrade that permanently eases bottlenecks for a cluster of communities? Independent analytics could illuminate these trade-offs, providing clear estimates of how each option translates to reliable megawatts and what it means for consumer bills.

Transparency would be key to building trust. A neutral, public-interest group—perhaps funded by regulators or philanthropies—could step in to curate data, model scenarios, and publish user-friendly tools. Imagine interactive maps highlighting which grid zones can reliably shuttle power during crises, or simple charts showing how a local upgrade might add hundreds of megawatts of effective capacity. These resources would demystify why a battery in one location merits higher reliability credit than a wind farm in another, based on evolving factors like shifting weather patterns or growing urban loads. All of this would be auditable and explained in plain terms, empowering regulators, journalists, and local leaders to hold the system accountable.

This hybrid model also clarifies roles and risks across the board. Generators get a fast track to revenue from energy sales, with reliability earnings scaling based on their accredited performance—motivating them to site projects thoughtfully or even fund upgrades that enhance their deliverability. Transmission owners, often utilities, could propose enhancements that compete in the auction, gaining regulatory approval and cost recovery if selected, which sidesteps endless debates over who foots the bill. Consumers, meanwhile, benefit from a least-cost approach that minimizes scarcity risks without the inefficiencies of prolonged interconnection queues.

Ultimately, we can escape the false choice between rapid integration and unyielding reliability. By letting projects connect quickly and then procuring a prudent layer of assured capacity through forward-looking auctions that weigh resources against strategic upgrades, the grid becomes more responsive to today’s demands. Performance is measured where it counts, penalties enforce accountability, and public dashboards provide the receipts. In an era of climate volatility and technological acceleration, this co-auction structure offers a pragmatic way to future-proof the power system—delivering both speed and security without the extremes that plague us now.